2023 Millage Rate Information

The Gordon County Schools Board of Education plans to lower the Tax Millage Rate for 2023 from 17.50 to 16.364. This rate reduction will offset some of the increase in property fair market values in recent higher appraisals.

Georgia law requires the advertisement of NOTICE OF PROPERTY TAX INCREASE if the proposed millage rate is higher than the calculated "rollback rate". The Gordon County Schools Board of Education will hold a meeting in September to discuss the Tax Millage Rate. The date, time and location of said meeting can be found below.

Please find additional information below related to the 2023 Tax Millage Rate.

Millage Rate Information

Date: September 11, 2023 at 6:00 PM

Location: Gordon County Schools - Board of Education Office

Address: 7300 Fairmount HWY SE Calhoun, GA 30701

Millage Rate FAQ's

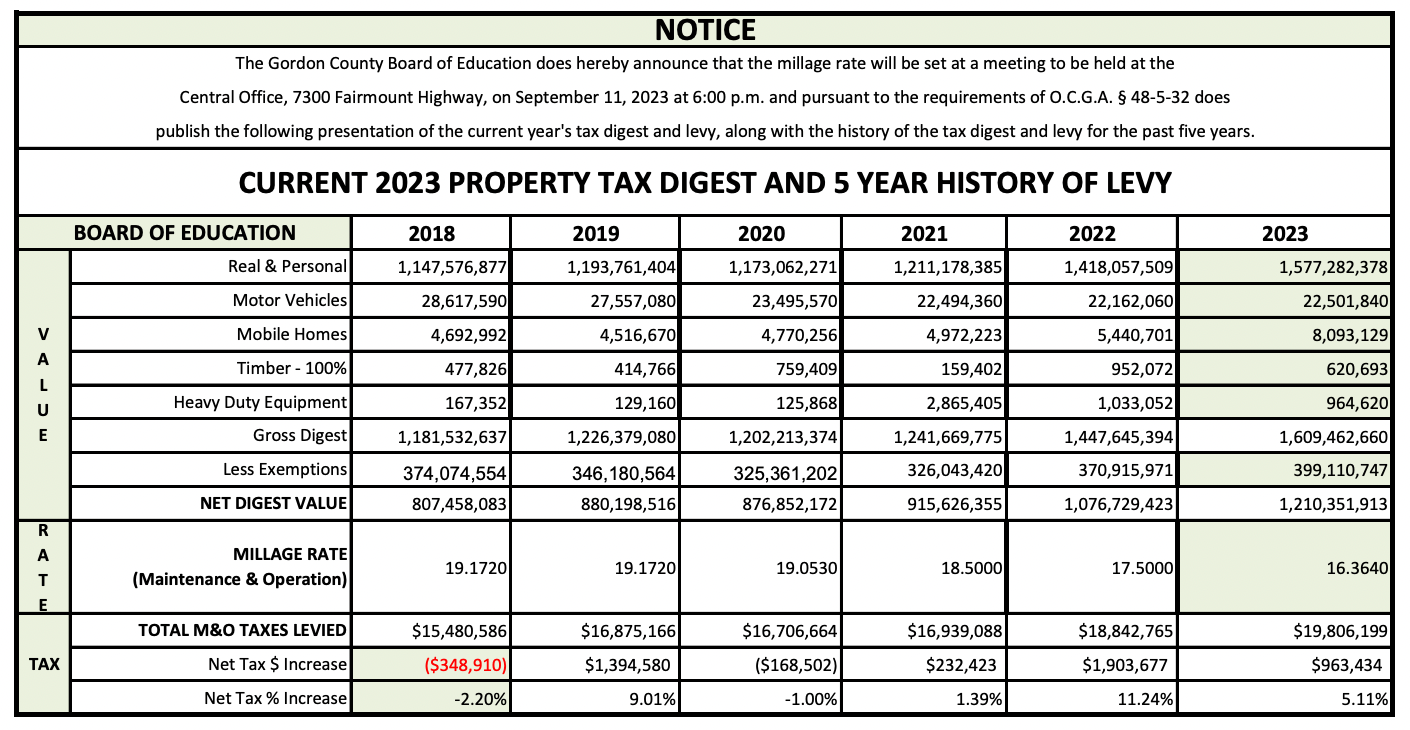

Current 2023 Property Tax Digest and 5 Year History of Levy

If the above image is not loading, you may access a downloadable copy of the Current 2023 Property Tax Digest and 5 Year History of Levy by clicking HERE.

10 Year Millage History

Digest Year | Millage Rate |

|---|---|

2012 | 19.309 |

2013 | 19.406 |

2014 | 19.274 |

2015 | 20.00 |

2016 | 19.85 |

2017 | 19.807 |

2018 | 19.172 |

2019 | 19.172 |

2020 | 19.053 |

2021 | 18.500 |

2022 | 17.5 |

2023 | TBD |